Understanding the types of business ownership is crucial for aspiring entrepreneurs and business owners. The business structure you choose can significantly impact your financial liability, tax obligations, and operational flexibility. In this comprehensive guide, we will explore various business ownership options, helping you make informed decisions tailored to your unique needs and goals.

Sole Proprietorship: Advantages and Disadvantages

A sole proprietorship is the simplest and most common form of business ownership. It’s where a single individual operates and owns the business, often without any formal registration or incorporation. Though it presents certain advantages, it also comes with disadvantages that must be considered.

Easy Establishment and Control

Starting a sole proprietorship is relatively easy. Entrepreneurs need minimal paperwork to set up, and in many cases, they can start operating immediately. This simplicity appeals to those looking to enter the business world quickly.

Since the sole proprietor retains complete control over the business decisions, there’s a significant advantage in agility and responsiveness. You can pivot your strategies without needing discussion or approval from partners or shareholders.

However, the very control that can lead to quick decisions can also lead to significant burdens on the owner. All responsibilities, whether in management, finance, or operations, fall entirely on the owner’s shoulders. The need for multitasking can become overwhelming, particularly as the business grows.

Financial Responsibility and Liability

A considerable disadvantage of a sole proprietorship is the risk of personal liability. Essentially, there is no legal distinction between personal and business assets. If the business incurs debt or faces lawsuits, creditors can pursue personal assets to satisfy claims.

Many entrepreneurs are hesitant to pursue a sole proprietorship due to this risk. It’s essential for potential owners to evaluate their ability to handle the financial implications of this ownership type. While the operational ease is attractive, the risk should not be underestimated.

Tax Implications

Another aspect to consider in a sole proprietorship is taxation. Income from the business is typically reported on the owner’s personal tax return, streamlining tax obligations. This simplicity expedites the process but may not always lead to the best tax outcomes, particularly as income increases.

Understanding the advantages and disadvantages of a sole proprietorship can inform your choice. While it has its merits, evaluating your risk tolerance and long-term goals is essential before committing to this type of business structure.

Partnership Structures: General vs. Limited

Partnerships can offer a diverse approach to business ownership, combining different skills, resources, and expertise. However, various structures exist, such as general partnerships and limited partnerships, each with its own attributes and implications.

General Partnerships: Shared Responsibility

In a general partnership, two or more individuals share ownership and operational responsibilities for the business. Each partner has equal rights but also bears equal liability, meaning they are personally responsible for the debts of the business.

The collaborative nature of general partnerships can yield innovative ideas and strategies. Partners can leverage each other’s strengths, share financial burdens, and balance workload, promoting growth. When partners share common goals and complementary skills, the partnership can thrive.

However, such arrangements necessitate a high level of trust and communication. Disagreements can lead to significant issues, causing potential failures if not managed effectively. It’s vital for partners to establish clear agreements and open lines of communication from the outset.

Limited Partnerships: Balancing Contribution and Liability

Limited partnerships consist of at least one general partner and one or more limited partners. While general partners actively manage the business, limited partners primarily provide capital or resources and enjoy limited liability, protecting their personal assets from claims against the business.

This structure enables a mixture of investment and operational control. Limited partners can invest in the business without taking on extensive risks, making it appealing for those who want to support business ventures without being tied to daily operations.

While this arrangement can seem beneficial, limited partners typically have no say in business decisions, which some may find limiting. Additionally, conflicts can arise if goals between general and limited partners diverge.

Legal Considerations and Agreements

Regardless of the partnership type, legal considerations should be a priority. A well-drafted partnership agreement outlines the contributions, responsibilities, profit-sharing arrangements, and dispute resolution methods between partners. Potential disputes can be costly and stressful, emphasizing the importance of preparing a formal agreement in advance.

Partnerships can provide a robust avenue for collaborative business growth, but due diligence and legal clarity are essential. Aspiring entrepreneurs should carefully weigh both types to determine which aligns best with their vision.

Limited Liability Companies (LLCs): A Flexible Option

Limited Liability Companies (LLCs) present a modern approach to business ownership, combining features of partnerships and corporations. They offer essential flexibility for business owners while maintaining legal protections.

Legal Protection

One of the most significant advantages of an LLC is limited liability protection. Similar to corporations, LLCs protect personal assets from business debts and liabilities. Owners, referred to as members, are not personally liable for business debts, which can create peace of mind.

This legal shield is appealing to many entrepreneurs, enabling them to take risks without fear of losing personal property. The notion of being able to separate personal wealth from business responsibilities can foster innovative endeavors and expand business horizons.

Tax Flexibility

Another attractive aspect of LLCs is their tax flexibility. By default, an LLC is treated as a pass-through entity, meaning that income is reported on the members’ personal tax returns, eliminating double taxation typically present in corporations.

However, LLCs also have the option to be taxed as a corporation if it is more advantageous financially. This versatility allows business owners to make strategic choices in alignment with their goals for growth and profit.

Management Structure

LLCs provide significant flexibility in their management structure. Members can opt for a member-managed or a manager-managed LLC, allowing owners to tailor operations based on personal preferences and strengths.

This adaptability makes LLCs an excellent option for business owners looking for a balanced approach to both control and liability protection. As businesses grow, owners can modify the internal structure to reflect the changing needs of the company.

Corporations: Types, Formation, and Compliance

Corporations are a well-established structure within the landscape of business ownership, offering distinct advantages and challenges. These entities can vary in type and require adherence to specific legal requirements.

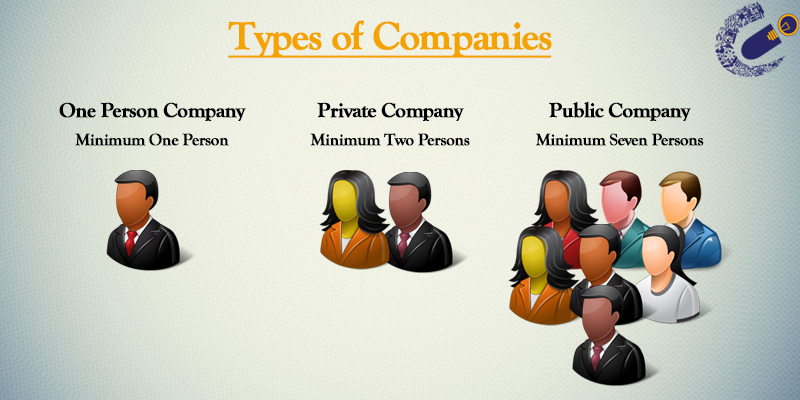

Types of Corporations

Corporations can be classified mainly into two categories: C-corporations and S-corporations.

C-corporations are subject to double taxation, where the corporation pays taxes on profits, and shareholders are taxed on dividends. However, this structure allows for unlimited shareholders and the potential for raising capital through shares.

S-corporations, on the other hand, avoid double taxation because profits pass through to shareholders’ personal tax returns. This type limits the number of shareholders and mandates specific eligibility criteria, which can restrict some businesses but also provides tax benefits.

The Formation Process

Forming a corporation demands a meticulous approach. Owners must file Articles of Incorporation with the state and adhere to various regulatory requirements. This process can involve attention to detail, including crafting bylaws and appointing a board of directors, which can prove time-consuming.

While there is a significant initial investment of time and resources, creating a corporation can yield substantial long-term benefits, such as enhanced credibility and access to funding opportunities.

Compliance and Reporting

Corporations must adhere to strict compliance and reporting requirements, including annual meetings, financial disclosure, and record-keeping. These obligations can add layers of complexity and regulatory scrutiny that small business owners might find overwhelming.

However, understanding these requirements and maintaining organized records can enhance the overall health of the business. Compliance not only builds credibility with investors and stakeholders but can also help secure necessary financing for growth.

Corporations provide a robust structure for business owners seeking to establish a long-term entity with significant growth potential. Careful planning and adherence to compliance can ultimately benefit those who navigate the intricacies of this ownership type.

Cooperatives: A Member-Owned Business Model

Cooperatives offer a unique approach to business ownership that prioritizes collective ownership and democratic decision-making. These member-owned entities differ significantly from traditional business structures.

The Cooperative Model

Cooperatives operate on the principle of mutual benefit. Members, who are often customers or employees, share in ownership and actively participate in decision-making processes. This model engenders a sense of community and shared purpose, aligning the interests of all members.

In a cooperative, profits are usually equitably distributed among members, reflecting their participation and contribution rather than being concentrated among a few owners. This model can enhance member loyalty and foster a collaborative spirit.

Types of Cooperatives

There are various types of cooperatives, including consumer cooperatives, worker cooperatives, and purchasing cooperatives, each tailored to meet specific needs.

Consumer cooperatives focus on providing goods or services to members, merging purchasing power to obtain better prices. Worker cooperatives maintain employee ownership and management, encouraging equitable treatment and shared benefits among workers.

Purchasing cooperatives enable independent businesses to achieve collective bargaining power, reducing costs through bulk buying agreements. Each type of cooperative addresses unique challenges in its sector, providing tailored solutions for member needs.

Formation and Governance

Forming a cooperative involves democratic principles, starting with establishing a charter and bylaws that outline governance structures. Members can elect a board of directors who represent their interests and make strategic decisions.

Cooperatives require a commitment to engagement from members, necessitating active participation in meetings and operations. This involvement creates shared accountability, ensuring members work collectively toward the cooperative’s success.

Cooperatives present an appealing alternative to traditional business models, offering unique advantages through collective ownership. They can empower individuals by fostering collaboration and mutual success, making them an attractive choice for community-oriented businesses.

Choosing the Right Business Ownership for Your Needs

Selecting the appropriate business ownership structure is a pivotal decision affecting the long-term prospects of an enterprise. Factors such as risks, taxation, and control must be thoroughly considered in aligning choices with personal and business values.

Personal Goals and Vision

Aspiring entrepreneurs must start by discussing personal goals and vision for their business. Consider questions like:

- Are you looking for flexibility and control?

- Do you prioritize limited liability?

- How much risk can you manage?

Understanding these objectives can help narrow down which type of business ownership might be the most suitable.

Financial Considerations

Examining the financial implications is equally crucial. Different structures present varied tax responsibilities, operational costs, and liability scenarios:

- Calculate potential startup costs and ongoing expenses.

- Analyze how individual ownership types impact personal taxes.

- Evaluate the flexibility of each structure concerning growth and investment.

Consider leveraging financial advisors who can provide insight tailored to your business plans.

Legal and Regulatory Obligations

Finally, assess the legal and regulatory obligations that come with forming different structures. Some may require substantial documentation, ongoing compliance, and reporting. Understanding these nuances can prevent unintended challenges.

Taking the time to research, consult with professionals, and weigh all factors can lead to informed decisions that align with your personal and business Aspirations.

Conclusion

Navigating the types of business ownership is a critical aspect of launching and growing a successful enterprise. From sole proprietorships to corporations and cooperatives, each ownership structure offers distinct advantages and challenges. Entrepreneurs must evaluate their risk tolerance, long-term goals, and financial considerations thoroughly. By understanding these ownership types and making informed decisions, you can lay the foundation for a thriving business that aligns with your vision for success.