When it comes to starting a new business, understanding the concept of company formation is crucial. This term encompasses the various steps and legal processes required to establish a new entity, and it plays a vital role in shaping the future of your entrepreneurial journey. In this comprehensive guide, we’ll unravel the complexities of company formation, providing you with insights to navigate this landscape effectively.

Navigating the Landscape of Company Formation: A Comprehensive Guide

Understanding company formation is like embarking on a thrilling yet challenging journey. It requires strategic planning, knowledge of legalities, and a clear vision for your future business. Before diving into the process, it’s essential to grasp the various elements involved in the formation of a company.

Creating a company goes beyond simply filling out forms and submitting them to the government. It encompasses understanding market conditions, legal structures, financial management, and the broader implications of your decisions. Here’s a broad overview of what you can expect.

The Importance of Thorough Research

Before beginning the process of company formation, conducting preliminary research is critical.

- Market Analysis: Knowing your target market is fundamental. Understand demographic aspects and competitors in your industry to gain a foothold and differentiate yourself.

- Financial Planning: Identifying your startup costs, potential revenue streams, and expenditure will set a practical foundation for your business. Prepare a detailed business plan to present to potential investors.

- Legal Implications: Different business structures come with varying legal responsibilities. Know the pros and cons of each to align with your business goals.

Effective research will guide your choices during the company formation process, reducing potential pitfalls that can derail your business vision.

The Evolution of Company Formation

Over the years, the methods of establishing a company have evolved significantly.

In the past, starting a business often involved cumbersome regulations and extensive paperwork. However, with developments in technology and global communication, the company formation process has become more accessible and efficient.

- Online Platforms: Many jurisdictions offer online platforms to facilitate the company registration process, making it easier to submit necessary documents and communicate with regulatory bodies.

- Globalization: The rise of remote work and global markets has prompted businesses to consider international company formation. Entrepreneurs can now easily operate in multiple countries, taking advantage of various economic environments.

Understanding these evolutionary trends is essential for anyone looking to start a new business venture today.

Key Players in Company Formation

The journey of company formation typically involves various stakeholders. Familiarizing yourself with these participants can help streamline the process.

- Business Owners: You, as an entrepreneur, will be at the helm of decision-making, steering the direction of your company while adhering to legal requirements.

- Legal Advisors: Having a legal expert is crucial for navigating the complex landscape of business laws and regulations, ensuring you remain compliant at every stage.

- Financial Advisors: Engaging a financial consultant can guide you through funding issues, provide insight into budgeting, and assist in maintaining financial health.

By recognizing the importance of each player in the process, you can create a robust support system for your new company.

Choosing the Right Business Structure: Key Considerations for Company Formation

Selecting the appropriate business structure is one of the essential steps in company formation. The choice you make will have lasting implications on your legal liability, tax obligations, and operational flexibility. Here we discuss popular structures, key considerations, and how to choose the right one for your business.

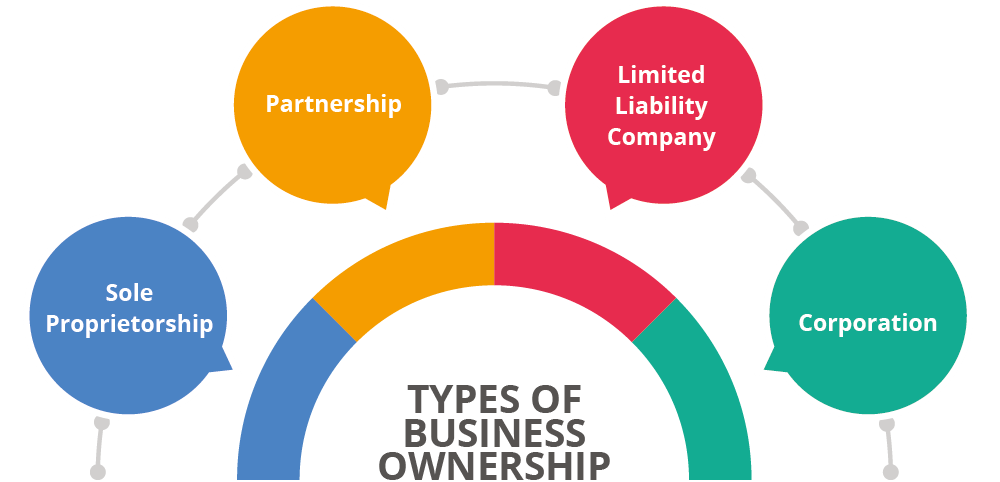

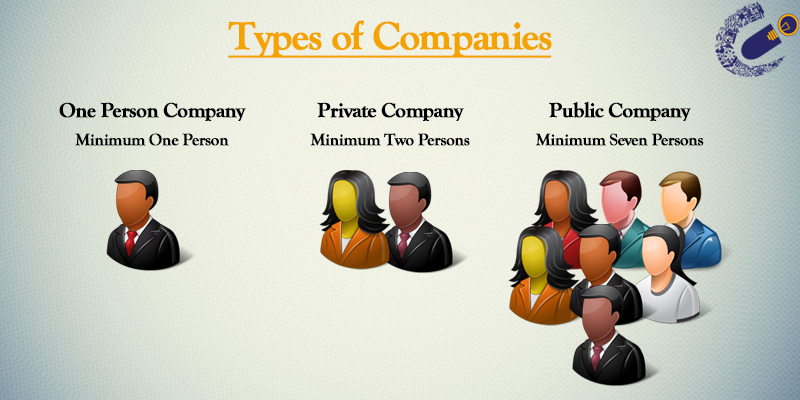

Common Business Structures

Business structures typically fall into several categories. Each has its unique advantages and disadvantages.

- Sole Proprietorship: This is the simplest structure, ideal for solo entrepreneurs. It offers complete control but comes with personal liability risks.

- Partnership: When two or more individuals operate a business together, forming a partnership can allow for shared liability and resources. However, disagreements can arise, so it’s vital to have a clear agreement.

- Limited Liability Company (LLC): This hybrid structure offers the advantages of both a corporation and a partnership. LLCs protect personal assets while allowing flexibility in management.

- Corporation: This more complex structure offers limited liability to its owners but requires higher administrative burdens. Corporations are subjected to double taxation, making them less appealing for some entrepreneurs.

Understanding these structures can help you align your business goals with the best-suited entity.

Pros and Cons of Each Structure

To make an informed decision, consider the benefits and drawbacks of each business structure.

- Sole Proprietorship:

- Pros: Easy to establish, complete control, and minimal regulations.

- Cons: Unlimited personal liability and difficulties in raising funds.

- Partnership:

- Pros: Shared resources, broadened skills, and simplified tax filings.

- Cons: Joint liability for debts and potential conflicts among partners.

- Limited Liability Company (LLC):

- Pros: Limited personal liability, flexible taxation options, and less paperwork.

- Cons: Varying state regulations and costs associated with formation.

- Corporation:

- Pros: Limited liability, easier access to capital, and enhanced credibility.

- Cons: Double taxation, complex regulations, and greater expense in compliance.

By weighing the pros and cons of each structure, you can determine which option aligns best with your business aspirations.

Personal Liability and Risk

When forming a company, one of the most vital considerations is your personal liability.

- Understanding Liability Exposure: How much personal risk are you willing to take? Certain structures, such as sole proprietorships and partnerships, expose you to unlimited liability, meaning creditors can pursue your personal assets.

- Selecting a Protective Structure: If minimizing personal liability is paramount, consider an LLC or a corporation. These structures shield your personal assets from business debts but come with increased complexity and cost.

When forming a company, your appetite for risk and the nature of your business will be critical in the decision-making process.

Essential Legal and Regulatory Requirements for Company Formation

Navigating the legal landscape is vital for successful company formation. Failing to comply with regulations can lead to severe repercussions, including fines and even dissolution of your company. This section covers the fundamental legal requirements you need to ensure a solid foundation for your business.

Registration Process

The registration process is one of the first steps in forming a company.

Before you start, you must choose an unforgettable name for your business and ensure it isn’t already taken by another entity. The registration process generally involves:

- Choosing a Business Name: Select a name that reflects your brand and is memorable. Verify its availability through a search on your local business registry.

- Filing the Necessary Forms: Complete the required registration forms, often available through local government websites. These documents typically include information about your business structure and ownership.

- Paying Registration Fees: Be prepared to pay a registration fee, which can vary depending on your location and business type.

Successfully navigating the registration process sets you off on the right path for your business.

Licenses and Permits

Depending on your type of business and its location, you may need various licenses and permits before opening your doors.

- Business License: Many municipalities require businesses to obtain a general business license. This may involve demonstrating compliance with local regulations.

- Health and Safety Permits: If your business involves food service or health care, specific health and safety permits may be necessary.

- Professional Licenses: Certain industries, including medical, legal, and financial services, require specialized licenses to operate legally.

By researching the necessary licenses and permits relevant to your industry, you can help ensure your business operates in compliance with the law.

Tax Identification and Compliance

When forming a company, understanding tax obligations is a critical step, as they can significantly impact your operations and bottom line.

- Getting an Employer Identification Number (EIN): Most businesses are required to obtain an EIN from the IRS. This unique number identifies your company for tax purposes.

- Understanding State and Local Taxes: Familiarize yourself with the tax requirements in your state and municipality, including sales tax, income tax, and unemployment tax.

- Filing Requirements: Be prepared to meet ongoing tax filing requirements. Missing deadlines can lead to fines and penalties, impacting your business’s financial health.

Managing tax obligations is a crucial responsibility that ensures compliance and fosters growth.

Streamlining the Company Formation Process: Expert Tips and Strategies

Embarking on the path to company formation can be daunting, but employing the right strategies can significantly streamline the process. From leveraging technology to seeking expert advice, there are several ways to ease your journey.

Embracing Technology

Technology has transformed how businesses operate, and it can play an essential role in simplifying company formation.

- Online Registration Platforms: Various jurisdictions allow entrepreneurs to register their companies online, reducing paperwork and expediting the process.

- Digital Legal Services: Several online platforms provide legal templates and documents for incorporation, making it easier to navigate compliance without incurring high legal fees.

- Project Management Tools: Utilizing project management software to track tasks, deadlines, and documentation can keep you organized throughout the formation process.

By embracing technology, you can turn a convoluted process into a streamlined experience.

Seeking Legal and Financial Advice

Engaging with professionals is a straightforward yet vital strategy to ensure your company formation process goes smoothly.

- Consulting Legal Advisors: An experienced attorney can address any legal concerns, guide you through the complexities of regulations, and ensure that your business is compliant.

- Engaging Financial Consultants: A financial expert can help navigate the financial aspects of formation, providing insights on budgeting, funding options, and legal tax strategies.

Building a solid support network of professionals can help you efficiently tackle challenges and make informed decisions along the way.

Create a Comprehensive Business Plan

A robust business plan serves as a foundation for your new venture and can significantly ease the company formation process.

- Defining Your Vision and Mission: Clearly articulate your vision and mission to guide strategic decision-making as you progress.

- Identifying Your Target Market: Conduct market research to identify your ideal customers, ensure a niche exists, and enhance your chances of success.

- Crafting Financial Projections: Include realistic revenue and expense forecasts to demonstrate viability to potential investors and secure funding.

A comprehensive business plan not only sets a clear roadmap for your venture but can also help mitigate risks associated with the formation process.

Funding Your New Venture: Investment Options for Company Formation

When embarking on company formation, one of the most critical considerations pertains to funding. Acquiring the necessary capital can dictate your business’s potential for growth and sustainability. Let’s explore various funding options available to entrepreneurs looking to establish their new businesses.

Self-Funding: Bootstrapping Your Business

Self-funding, or bootstrapping, refers to using personal savings or income to finance your business venture.

- Advantages of Self-Funding: Financing your start-up can allow for complete control over your business, as you won’t owe debts or dilute equity to investors.

- Risks Involved: However, relying solely on personal funds carries significant risks, as any shortfall could impact your financial stability.

Consider carefully if bootstrapping is the right choice for you based on your risk tolerance and investment capacity.

Seeking Investment from Friends and Family

Turning to friends and family for initial funding is a common practice among many entrepreneurs.

- Benefits of Friendly Investments: This informal approach can provide quick access to funds without the rigorous processes often associated with formal investment rounds.

- Potential Pitfalls: Mixing personal relationships with business can lead to complications. Clearly outline terms, repayment plans, and expectations to avoid conflicts.

When discussing funding with loved ones, transparency and clear agreements are crucial.

Attracting Angel Investors and Venture Capitalists

As your business grows and requires additional funding, you may want to explore external investment sources like angel investors and venture capitalists.

- Understanding Angel Investors: These are typically high-net-worth individuals who provide capital for startups in exchange for equity. They are often willing to help with mentorship and guidance as well.

- Exploring Venture Capitalists: Venture capital firms tend to invest larger sums and may have stricter requirements. They provide financial backing in exchange for equity and are often involved in major decision-making.

Connecting with the right investors can help secure the necessary funding while providing invaluable insights and resources.

Crowdfunding: Harnessing the Power of the Crowd

Crowdfunding has gained popularity as an alternative funding method, particularly in the digital age.

- Various Platforms Available: Websites like Kickstarter and Indiegogo allow you to present your business idea and raise funds from a community of backers interested in supporting new ventures.

- Marketing Benefits: Beyond financial backing, crowdfunding campaigns can enhance visibility, validate your business idea, and build a loyal customer base before your official launch.

As you consider crowdfunding, remember that success relies heavily on effective marketing and engagement strategies.

Post-Formation Compliance: Maintaining Good Standing for Your Company

Once your company is established through company formation, it’s imperative to understand ongoing compliance requirements. Adhering to these regulations is essential for maintaining good standing and protecting your company’s reputation. Here’s what you need to know.

Ongoing Reporting Requirements

After a company is formed, regular reporting and updates are necessary to keep it compliant with local, state, and federal regulations.

- Annual Reports: Most jurisdictions require businesses to file annual reports detailing their financial status, ownership, and other key business information.

- Change Notifications: If any significant changes occur, such as a change in ownership or business address, it’s crucial to update relevant authorities promptly.

- Tax Filings: Ensure that you comply with federal, state, and local tax obligations, as businesses often face penalties for late or inaccurate filings.

Understanding your reporting requirements and adhering to deadlines will safeguard your company’s good standing.

Importing Compliance Standards

Implementing structured compliance protocols within your company can prevent future complications.

- Establishing Internal Policies: Develop clear internal policies that guide employees on compliance standards and expectations, fostering a culture of accountability.

- Training Programs: Conduct regular training sessions for employees to keep them informed about any regulatory changes and to ensure adherence to compliance procedures.

- Regular Audits: Consider performing periodic internal audits to assess compliance efficiency and make necessary adjustments.

By creating a culture of compliance, you are better equipped to prevent mishaps that might jeopardize your business’s standing.

Addressing Non-Compliance Issues

It’s essential to approach any non-compliance issues proactively, as they can have serious consequences for your company.

- Identifying Issues Early: Regularly monitor operations and reporting to catch compliance issues before they escalate.

- Corrective Actions: If non-compliance is identified, swift corrective actions should be taken to rectify the oversight.

- Legal Counsel: Engage legal counsel if facing significant compliance issues to navigate potential legal repercussions effectively.

By staying vigilant and addressing compliance issues promptly, you can maintain your company’s reputation and operational integrity.

Conclusion

The journey of company formation is multi-faceted and requires a blend of strategic planning, legal compliance, and financial acumen. By understanding the landscape, selecting the right structure, fulfilling legal requirements, streamlining the process, exploring funding options, and maintaining good standing, you pave the way for a successful enterprise. With dedication and insight, you can transform your business idea into a thriving reality. Your entrepreneurial journey awaits, and with the knowledge gained from this guide, you are well-equipped to conquer the challenges ahead.