Introduction

Investors want evidence, not essays. If your team is still drafting wordy plans and stitching together spreadsheets, you’re wasting time and credibility — and slowing down fundraising. AI-powered, editable templates and document automation can produce a data-first, investor-ready pack in hours: auto-generated narratives, linked financials pulled from invoices and bookkeeping, and repeatable sections for market analysis, go‑to‑market and unit economics. This post walks through why investors now expect concise, numbers-forward plans, how AI-assisted business templates accelerate drafting, the mechanics of auto-populating forecasts, governance best practices for diligence, and a step‑by‑step workflow to build investor-ready plans in Formtify.

Why investors now expect data-driven, concise business plans

Investors want evidence, not essays. Long narratives are less persuasive than a compact plan that surfaces the key numbers and assumptions up front.

Modern investors expect a short executive summary and immediate access to data: revenue run-rate, unit economics, burn and runway, customer acquisition cost (CAC), lifetime value (LTV) and growth rate. A clear, data-first approach signals discipline and makes diligence faster.

What that looks like

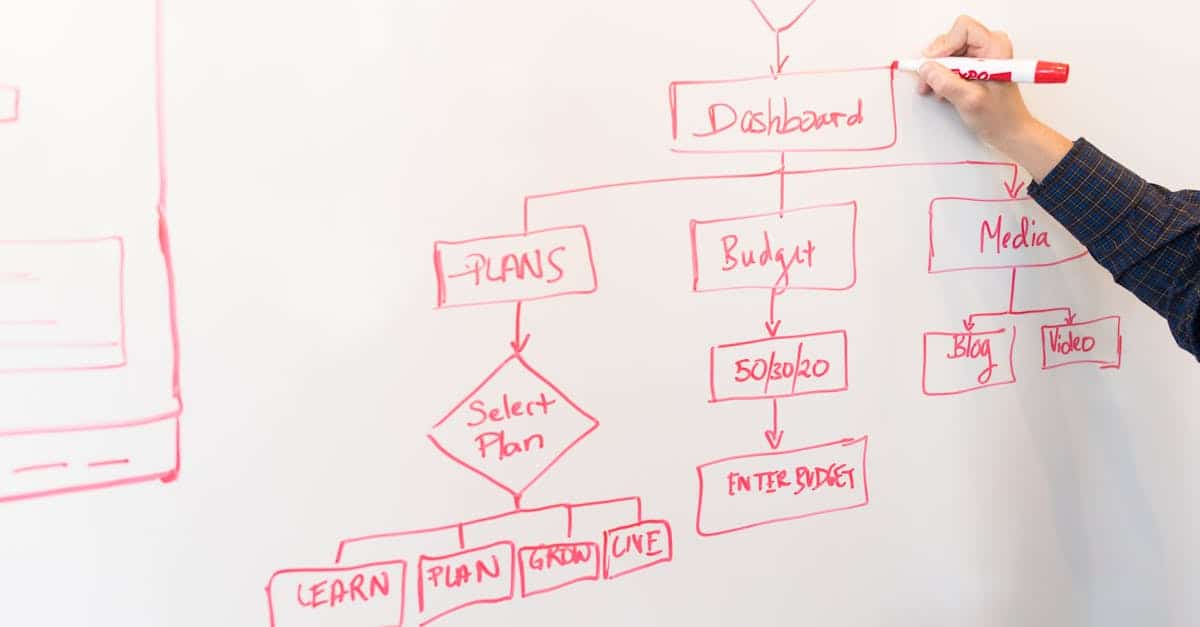

- One-page KPI dashboard with links to supporting schedules.

- Assumptions table tied to financial projections.

- Milestone-driven roadmap showing use of funds and expected inflection points.

Using proven business templates — a focused business plan template and concise investor deck patterns — helps teams present this information consistently. These templates work for startups and later-stage companies alike and reduce back-and-forth during investor Q&A.

How AI‑assisted, editable business plan templates accelerate drafting

AI makes the first draft usable and collaborative. An editable business plan template powered by AI can produce a coherent baseline plan in minutes instead of days, leaving the team to refine strategy and numbers.

Key productivity gains

- Auto-generated narrative from bullet inputs (market, product, traction).

- Editable sections for legal, HR and operations — useful when combining with corporate templates like an LLC operating agreement.

- Multiple export formats (business templates Word and business templates Excel) for internal review or investor submission.

AI also helps standardize language across proposal template, marketing plan template and meeting agenda template artifacts, so your investor-facing materials stay consistent and professional.

Look for tools that offer both business templates free previews and premium options so teams can download and customize the right corporate and office templates for businesses without rebuilding from scratch.

Auto‑populating financials and forecasts from invoices, bookkeeping and templates

Link source data, not spreadsheets manually. The fastest way to credible forecasts is to pull actuals from invoices, bookkeeping systems and financial templates, then run scenarios on top.

Practical flow

- Import invoice templates or connect your accounting feed to auto-fill revenue and receivables.

- Map invoice lines to P&L categories and cash-flow models using business templates Excel patterns or financial templates for businesses.

- Generate AR aging, burn-rate and forward-looking cash forecasts; instantly update the investor-ready dashboard.

Auto-population reduces errors and saves analyst time. It also makes it easy to provide downloadable exhibits (business templates download) in formats investors prefer, whether Excel schedules or PDF summaries.

Template patterns for market analysis, go‑to‑market strategy, and unit economics

Templates are most useful when they enforce a repeatable, investor-friendly structure. Pattern-driven sections ensure you capture the right inputs and calculate comparable outputs across products and time periods.

Market analysis

Use a consistent framework: TAM / SAM / SOM, segmentation, competitor matrix and validated customer interviews. Include a short assumptions list and sourcing for each number.

Go‑to‑market

Playbook-style sections: target segments, channels, sales motions, expected conversion funnels, and a marketing plan template with spend-to-outcome templates so you can show CAC payback and channel ROI.

Unit economics

Standard unit model: revenue per customer, gross margin, contribution margin, CAC, churn and LTV. Provide a one-click summary that feeds into the financial model so investors can test scenarios quickly.

- These patterns make the document scannable for investors and reusable as business document templates for future products.

- They also pair well with corporate templates for finance, HR templates for business planning, and proposal template assets.

Versioning, assumptions disclosure and template governance for investor due diligence

Clear versioning and transparent assumptions are non‑negotiable in diligence. Investors want to know what changed, when, and why — and to be able to trace key metrics back to source documents.

Governance checklist

- Version control: timestamped versions with change notes and author attribution.

- Assumptions log: a single table that lists each assumption, its source, sensitivity and who owns it.

- Audit trail: linkable exhibits (invoices, bank statements, term sheets such as a post‑money SAFE) so every projection has a traceable origin; example: post‑money SAFE.

- Template governance: control which business templates are approved for investor use, and maintain a library of business document templates, office templates for businesses, and corporate templates with role-based edit rights.

This discipline speeds diligence and reduces requests for follow-up, since investors can validate numbers without recreating your work.

Step‑by‑step: build an investor‑ready plan in Formtify using templates and AI

Follow a short, repeatable workflow to produce an investor-ready pack:

1) Pick and preload templates

- Select a business plan template and any supporting templates — marketing plan template, proposal template, meeting agenda template — and choose export formats (business templates Word or business templates Excel).

- Preload legal and corporate docs like an LLC operating agreement and any term sheets (for example, the post‑money SAFE).

2) Ingest data

- Import invoices via invoice templates or connect your accounting system to auto-populate revenue and expenses.

- Upload KPIs and historical metrics; use office templates for businesses to standardize imports.

3) Run AI draft and map templates

- Use AI to create the first draft narrative and populate tables from the imported data.

- Map unit economics, CAC/LTV, and go‑to‑market inputs into the model.

4) Validate assumptions and version

- Fill the assumptions table, attach source documents, and create a new version with change notes.

- Run sensitivity scenarios and export results as financial templates for businesses or downloadable Excel schedules (business templates download).

5) Polish and share

- Finalize the one-page KPI dashboard, embed the marketing plan template summary, and generate a clean PDF or Word output for investors.

- Keep an editable copy for product and sales teams so the plan can be reused across proposals and meeting agenda templates.

For teams building pitch materials quickly, this approach — mixing AI, approved templates and live financials — is the fastest way to produce consistent, credible investor-ready documents. Seek tools that offer both business templates free trials and premium libraries so you can scale template use across your company.

Summary

Investors today expect short, numbers‑forward plans that link clear assumptions to verifiable financials, and AI‑assisted, editable workflows are the fastest way to deliver that. Using auto‑populated forecasts, pattern‑driven sections for market and unit economics, and disciplined versioning reduces back‑and‑forth and speeds diligence — while keeping your narratives concise and consistent. For HR and legal teams this means fewer manual edits, standardized language across offers and corporate documents, and built‑in audit trails and role‑based controls that support compliance and approval processes. Adopt proven business templates and a repeatable Formtify workflow to produce investor‑ready materials in hours, not weeks — try it at https://formtify.app.

FAQs

What are business templates?

Business templates are prebuilt document structures — like plans, invoices, or contracts — that standardize inputs and outputs so teams can produce consistent, investor‑ready materials quickly. They reduce repetitive drafting, ensure key sections (assumptions, KPIs, financials) are present, and make it easier to trace numbers back to source documents.

Where can I download free business templates?

Many platforms and marketplaces offer free business templates as previews or starter kits, and some vendors provide free trials that let you export basic formats like Word or Excel. For a more integrated experience that auto‑populates financials and connects to your accounting feeds, consider solutions that bundle templates with document automation tools.

Can I use business templates for legal documents?

Yes—templates can be used for standard legal documents such as operating agreements, NDAs, and term sheets, but they should be reviewed by legal counsel before signing. Using approved corporate templates with role‑based edit controls helps HR and legal maintain compliance while speeding routine document creation.

How do I customize a business template for my company?

Start by preloading your historical KPIs, invoices, and any corporate documents, then use the template’s editable sections to adjust assumptions, unit economics, and go‑to‑market details. Maintain an assumptions log and a versioned copy so changes are auditable and easy to revert if investors request clarifications.

Which templates are essential for startups?

Essential templates for startups include a concise business plan or one‑page KPI dashboard, financial projection templates (P&L and cash‑flow), a go‑to‑market playbook, investor pitch deck patterns, and basic legal templates like operating agreements or SAFE term sheets. These help teams present consistent numbers, speed diligence, and reduce the time spent on repetitive drafting.