Introduction

Raising capital in 2025 still comes down to one thing: clear, verifiable numbers — and yet most teams waste weeks reconciling spreadsheets, fixing formatting, and chasing signatures. If you manage HR, compliance, or legal, those delays create real risk: version drift, inconsistent cap tables, and stalled diligence that slow deals and burn runway.

This guide shows how document automation and AI can bridge that gap by converting your assumptions and live models into investor-ready drafts — from a concise executive summary to scenario-driven financial projections — packaged as editable Word sections with linked spreadsheets, cap table and SAFE integration, QA controls, and export/e-sign workflows. Use these practical steps to produce one-source-of-truth business templates and financials that investors will actually trust.

Why investor-ready business plans still matter in 2025 (metrics investors care about)

Investor decisions are still driven by measurable signals. A clean, data-backed business plan remains the quickest way to prove traction and unit economics. Investors in 2025 want to see numbers that map directly to growth and risk.

Key metrics to include

-

ARR / MRR and growth rate: month-over-month and year-over-year trends, bookings vs. recognized revenue.

-

Gross margin & contribution margin: product-level margins and how they improve with scale.

-

Customer economics: CAC, LTV, CAC payback period, retention cohorts and churn.

-

Sales efficiency: revenue per sales rep, Magic Number, pipeline conversion rates.

-

Runway & burn metrics: burn rate, runway at current spend, scenarios by hiring plans.

-

Market sizing & defensibility: TAM/SAM/SOM, competitive positioning, and early evidence of defensibility.

Why a structured plan still matters

Investors don’t just want raw data; they want it in an interpretable format. A well-built business plan template or business model canvas template maps metrics to narrative: how the team will move KPIs, where assumptions live, and what milestones unlock follow-on funding.

For startups, bundling your plan with legal and cap-related templates (SAFE, ESOP, purchase agreements) reduces friction during diligence. See a SAFE example for consistency: https://formtify.app/set/postmoney-safe—valuation-cap-only—canada-743zc.

How AI can auto-generate executive summaries, market analysis and financial projections from prompts

AI can speed up the drafting process, but it works best when paired with structured inputs. Think of AI as a drafting engine that converts your assumptions and data into readable sections: an executive summary, market analysis, and baseline financial projections.

What to provide the model

-

Company facts: stage, traction metrics, funding history.

-

Market inputs: TAM/SAM/SOM estimates, primary competitors, pricing strategy.

-

Financial assumptions: revenue model, pricing tiers, headcount plan, CAC and churn assumptions.

Prompt examples & validation

Use prompts that request citations to the input assumptions and ask the model to generate sensitivity scenarios (best / base / worst). Always validate AI outputs against the source spreadsheet or template. AI can draft a clear executive summary and a narrative around unit economics, but it should not be the final approver of numbers.

For teams building tools, offering exportable drafts into business templates Word, business templates Google Docs, or linked business templates excel models streamlines handoff to legal and finance reviewers.

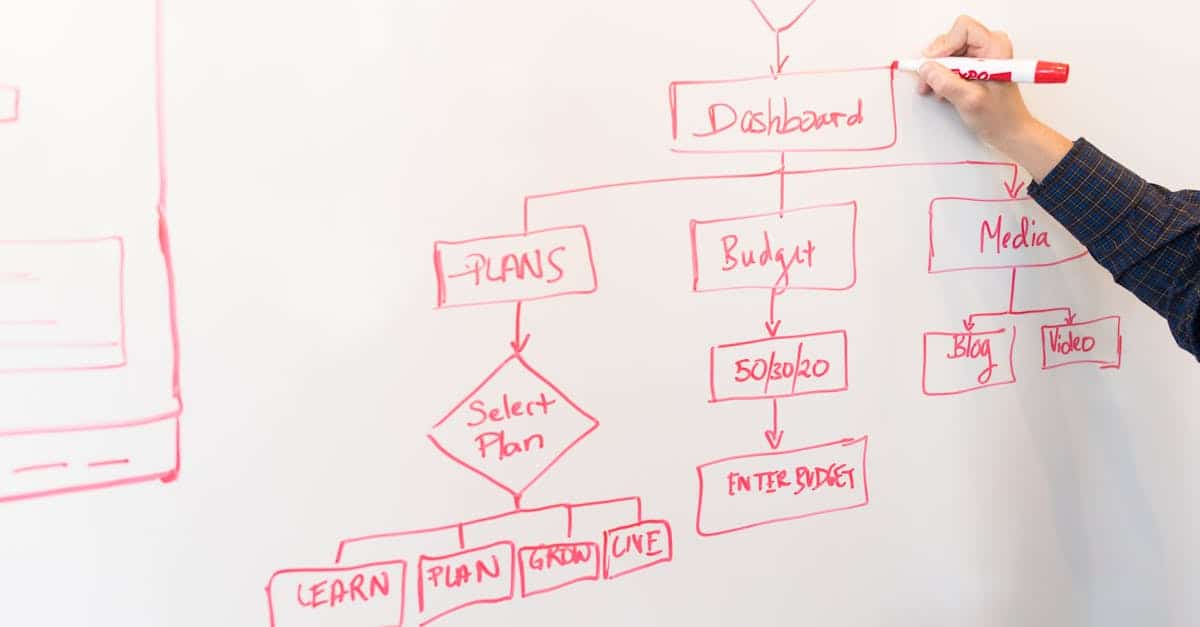

Template structure: editable Word sections, financial model tables, and appendix variables to include

Design templates so the narrative and numbers are separable. Use an editable Word main document for storytelling and a linked spreadsheet for calculations.

Core structure

-

Cover & title page — version, date, contact.

-

Executive summary (editable Word section) — one page with key metrics and asks.

-

Market & product — research, positioning, uses of proceeds.

-

Financial model tables — revenue, COGS, OpEx, cash flow, capex, scenario tabs in Excel/Sheets.

-

Team & milestones — hires, timeline, KPIs to hit.

-

Appendix / variables — raw assumptions, data sources, cap table, legal summaries.

Appendix variables to include

-

Pricing per product / ARPA by cohort.

-

Customer acquisition funnel: CAC by channel and conversion rates.

-

Hiring plan and fully-burdened costs.

-

Tax & legal assumptions (linked to agreements like an ESOP or LLC operating agreement): https://formtify.app/set/esop-set-9eu26 and https://formtify.app/set/llc-operating-agreement—delaware-5fri3.

-

Cap table summary and any outstanding SAFEs or stock purchase terms: https://formtify.app/set/stock-purchase-agreement-auo8w and https://formtify.app/set/postmoney-safe—valuation-cap-only—canada-743zc.

Providing editable business plan template sections makes it easy for finance to update models without breaking narrative formatting. Include a separate business model canvas template tab for quick investor one-pagers.

Integration patterns: connect templates to spreadsheet data, cap table and SAFE templates for consistency

Templates are most powerful when they link to live data. Choose integration patterns that minimize manual copy-paste and ensure a single source of truth for numbers that investors will check.

Common integration approaches

-

Linked Google Sheets: put models in Google Sheets and use the Word/Docs template to pull summary tables via linked ranges or Apps Script.

-

Excel with Power Query / Office 365: maintain the financial model in Excel and paste dynamic ranges into Word. Use cloud storage or SharePoint to keep versions synced.

-

API-driven sync: for product or CRM data (MRR, churn), push metrics to the model using a small ETL or Zapier/Make automation.

Cap table & SAFE consistency

Keep a canonical cap table that feeds dilution and ownership schedules into the model. Store SAFE and seed terms alongside cap table rows to auto-calc conversion effects. Use vetted templates for legal consistency:

-

SAFE example: https://formtify.app/set/postmoney-safe—valuation-cap-only—canada-743zc

-

ESOP governance pack: https://formtify.app/set/esop-set-9eu26

-

Stock purchase and operating agreements for downstream documents: https://formtify.app/set/stock-purchase-agreement-auo8w and https://formtify.app/set/llc-operating-agreement—delaware-5fri3

These links help ensure that the capitalization assumptions in your business templates for startups match the legal paperwork investors will request during diligence.

Testing & QA: versioning, template governance and investor-friendly formatting tips

Rigorous QA protects credibility. Create simple governance rules and a tested checklist so each outgoing plan meets investor expectations.

Versioning & governance

-

Version naming: use semantic names (v1.0, v1.1—fundraise-2025) and include a changelog in the document footer.

-

Access controls: restrict edit rights on the canonical model; allow suggested edits in the Word/Docs narrative.

-

Review gates: require sign-off from finance and the CEO before distribution.

QA checklist

-

All numbers reconcile to the canonical spreadsheet; include source links.

-

No hidden formulas or circular references that could confuse investors.

-

Consistency in currency, time periods, and rounding.

-

Legal terms and capitalization are reflected in the cap table and referenced agreements.

Investor-friendly formatting tips

-

Readable fonts & spacing: use a clean sans-serif and 10–12pt body text.

-

Tables & charts: keep one clear takeaway per table; label axes and timeframes.

-

Executive summary: one page, bulleted highlights and the ask (amount and use of proceeds).

Treat templates as living products in a corporate templates library or entrepreneurship templates bundle — maintain them like code with releases and bug fixes.

Distribution & handoff: export options, e‑sign workflows and converting plans into pitch decks

Build distribution channels that match how investors prefer to consume documents. Offer multiple formats and a clear e-sign path to speed diligence and term execution.

Export & delivery options

-

PDF: the default for sharing — ensure embedded fonts and live links to sources.

-

Editable Word / Google Docs: for investors who want to comment; keep a read-only canonical copy.

-

Excel / Google Sheets: export or share the model with view/comment permissions.

E-sign & legal handoff

-

Integrate with DocuSign or Adobe Sign for subscription agreements, SAFEs, or stock purchase agreements. Link the executed paperwork back to the plan’s appendix.

-

Prepare a short diligence packet with the plan, cap table, SAFE/SPA links, and the ESOP overview (examples: https://formtify.app/set/postmoney-safe—valuation-cap-only—canada-743zc, https://formtify.app/set/stock-purchase-agreement-auo8w, https://formtify.app/set/esop-set-9eu26).

Converting plans into pitch decks

Automate a one-click export from key template sections into a slide deck (cover, problem, solution, market, traction, financials, ask). Many startups maintain a separate marketing plan template or proposal template for investor-facing collateral; others generate a condensed deck directly from the business plan template and the business model canvas template.

Finally, keep distribution workflows simple and track who has which version. Make it easy for investors to find the numbers they care about, and the rest of the process — from signing a SAFE to closing a stock purchase — will move much faster.

Summary

In short, combining document automation with structured templates and linked financial models turns fragmented fundraising work into a repeatable, auditable process. The approach described here — editable Word sections, live spreadsheets, cap table/SAFE integration, and simple QA gates — reduces version drift, clarifies sign‑off paths, and speeds diligence for HR, compliance, and legal teams while preserving auditability. Use these practices to create a single source of truth that investors can verify; start with ready examples and integrations to move faster with your next round. Explore practical template sets and exports at https://formtify.app.

FAQs

What are business templates?

Business templates are pre‑formatted documents and models that standardize common company artifacts like plans, invoices, and proposals. They bundle narrative sections with linked spreadsheets and variables so teams can update assumptions without breaking formatting or losing traceability.

Where can I find free business templates?

Free business templates are available from template marketplaces, startup accelerators, and some legal or finance tool providers. For vetted, editable templates that include legal and financial examples you can also review curated collections such as those on Formtify and similar libraries.

How do I customize a business template?

Start by updating the appendix variables or canonical spreadsheet with your company facts, pricing, and hiring plan so the model drives the narrative. Keep edits to the editable Word sections for storytelling and protect the canonical model with restricted access; then validate outputs with a quick reconciliation before sharing.

Are business templates legal to use?

Yes — business templates are legal to use as starting points, but they are not a substitute for tailored legal advice. For binding agreements or jurisdiction‑specific terms (e.g., SAFEs, stock purchase agreements), use vetted templates and have counsel review final documents before execution.

How do I choose the right business template?

Pick a template that matches your use case (investor plan, pitch deck, financial model), supports editable Word/Sheets or Excel integrations, and includes cap table/SAFE alignment if you’re fundraising. Prioritize templates with clear QA controls, versioning, and export/e‑sign workflows so HR and legal can govern distribution and approvals.