Introduction

Cut the invoice friction. Invoices and receipts — with manual data entry, PO mismatches, and approval bottlenecks — are a hidden drain on finance, HR, and procurement teams, creating slow cycles, costly errors, and missed discounts. This playbook shows how document automation, combining OCR, NLP, and an AI document reader, turns messy scans and PDFs into validated, postable transactions while keeping humans in the loop for exceptions. You’ll get a practical roadmap: preprocessing and layout-aware extraction, line-item and vendor validation, rules-based exception routing with human-in-the-loop reviews, ERP and payroll integrations, templates for high-value artifacts, and the KPIs to prove ROI (throughput, touchless rate, DPO, and audit readiness). Use these steps to prioritize quick wins, lower cost‑per‑invoice, and make month‑end close predictable and auditable.

Common pain points in invoice workflows and the ROI of automation

Pain points

-

Manual data entry and paper handling create slow cycles, high error rates, and low scalability — teams waste time re-keying vendor names, amounts, and line items.

-

Missing or inconsistent PO matching leads to holds and disputes between procurement and AP.

-

Approval bottlenecks for non-routine invoices cause late payments, missed discounts, and frictions with suppliers.

-

Poor visibility makes reconciliation, audit requests, and month‑end close expensive and time consuming.

Why automation pays off

Moving from manual processing to intelligent document processing (combining OCR, NLP, and model-based extraction) delivers measurable ROI: faster throughput, fewer exceptions, lower cost-per-invoice, and improved compliance. Automation often increases the touchless rate (fully automated invoices) and reduces DPO variability by removing human delays.

Key ROI levers to track

-

Cost per invoice — reduction from automation and reduced FTE time.

-

Cycle time / throughput — invoices processed per hour and end-to-end days.

-

Error and exception rates — drop in manual corrections and disputes.

-

DPO and discount capture — earlier payments and fewer missed early-pay discounts.

Framing ROI in these operational terms helps get buy‑in from finance and IT for an AI document initiative and aligns expectations about timelines and measurable gains.

Building the OCR + NLP pipeline: image cleanup, OCR, line-item extraction, and validation

Preprocessing (image cleanup)

Start by cleanly capturing documents. Use scanning best practices (deskew, despeckle, contrast adjustment, noise removal) and standardize formats. Good input raises OCR accuracy dramatically and speeds downstream document ai tasks like table extraction.

OCR and layout analysis

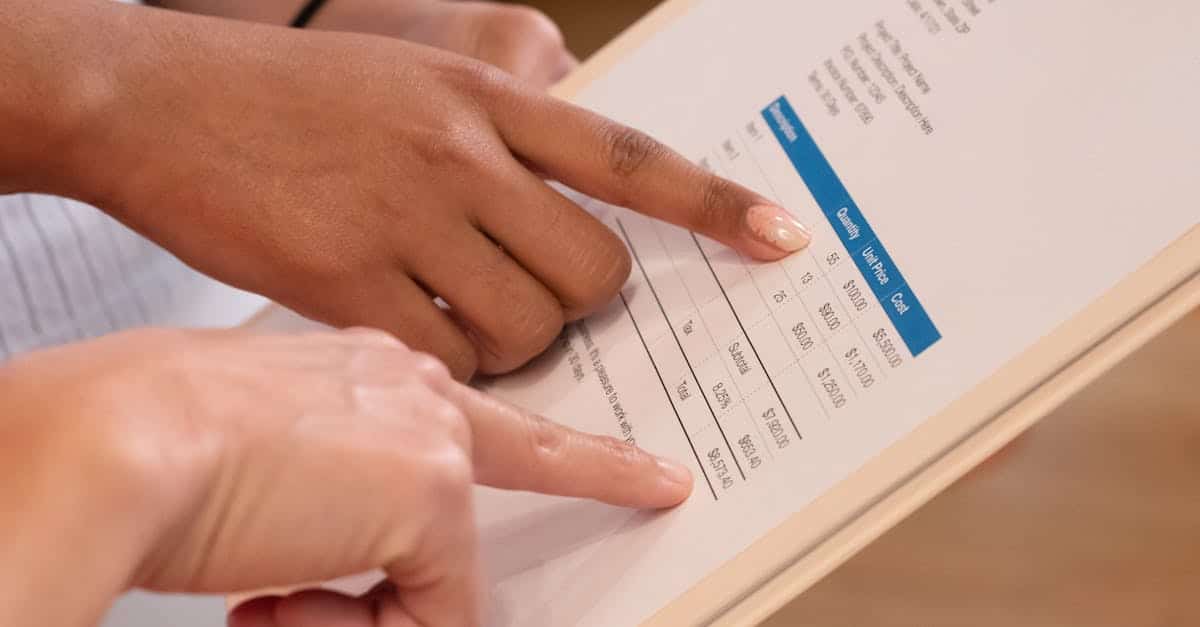

Choose an OCR engine and a layout-aware document ai model that identifies blocks (headers, tables, footers). Combine OCR text with coordinates to preserve structure — this is vital for accurate line-item extraction and mapping totals to the right fields.

Line-item extraction and NLP

For invoices and receipts, extract table rows (quantity, unit price, description) and vendor-level fields (invoice number, date, totals). Use a mix of:

-

Rule-based patterns and regexes for well-known formats.

-

Model-based entity extraction (NLP) to handle varied language and layouts.

-

Table recognition models that convert OCR output into structured rows.

Validation and enrichment

Map extracted fields to master data (vendor records, tax rates, GL codes). Add validation rules (sum checks, PO matches, currency checks) and confidence scoring. Low-confidence items should be flagged for review.

Iterative training and intelligent document processing

Use human-labeled ground truth to train the ai document reader and refine models. Active learning — routing uncertain cases to annotators and feeding corrections back — improves accuracy over time and reduces manual review.

Exception handling and approval routing: combining rules-based logic with human-in-the-loop reviews

Triage with confidence thresholds

Use confidence scores from your ai document processing to automatically classify invoices: high-confidence = auto-post; mid-confidence = human‑in‑the‑loop; low-confidence = full review. This hybrid approach balances speed with safety.

Rules-based routing

Implement deterministic rules for common cases: route invoices above a threshold amount to managers, send vendor-specific invoices to contract owners, or escalate PO-mismatches to procurement. Rules provide predictable behavior and simplify audits.

Human-in-the-loop best practices

-

Provide a fast annotation UI that shows the original image, extracted fields, and suggested fixes.

-

Set SLAs for reviewers and build queues by urgency or dollar value.

-

Capture reviewer corrections as training data to improve the ai document summarizer/reader over time.

Auditability and traceability

Log every decision, rule trigger, and human correction. Maintain versioned templates and approval histories so audits can trace why an invoice was paid or held.

Integrations with accounting systems, AP automation, and payroll reconciliation

Integration patterns

Connect your ai document pipeline to ERPs and payroll systems via APIs, secure SFTP drops, or middleware platforms. Choose real‑time webhooks for immediate posting and batch exports for high-volume reconciliation runs.

Mapping and idempotency

Define canonical field mappings (vendor ID, invoice number, PO, GL account) and implement idempotency checks so re-processing doesn’t create duplicate entries. Normalize currencies and tax treatments before posting.

AP automation and downstream flows

Automated posting should integrate with payment runs, vendor statements, and cash‑forecasting. For payroll reconciliation, feed receipt-level or benefits documents into the same document ai reader to match against payroll journals and deductions.

Security and compliance

Ensure role-based access controls, encrypted transport/storage, and data retention policies to meet SOX, GDPR, or industry-specific requirements. Test integrations with a sandbox ERP account before production go‑live.

Templates and artifacts to automate: invoices, purchase agreements, promissory notes, and credit agreements

Which artifacts to prioritize

Start with high-volume, high-value documents: invoices and purchase agreements. Move next to legal and financial forms where structured extraction and ai document summarization add value: promissory notes and credit agreements.

Template strategy

Maintain a library of templates and extraction rules per artifact type. Use layout templates for common invoice formats plus model-based extraction for non‑standard docs.

Practical templates

-

Invoice template: capture vendor, invoice number, date, line items, taxes, and totals. Automate automated invoice processing and connect to your AP workflow. (Example: invoice template)

-

Purchase agreement: extract parties, effective date, key terms, and termination clauses — useful for PO matching and contract analysis with ai. (Example: purchase agreement)

-

Promissory note: pull principal, interest rate, maturity date, and payment schedule to automate ledger entries. (Example: promissory note)

-

Credit agreement: capture covenants, facility amounts, and guarantors to feed compliance checks and credit workflows. (Example: credit agreement)

Enhancements with AI

Use an ai document generator to draft standard terms, an ai document summarizer to produce executive summaries of long contracts, and an ai document reader/scanner to capture data from scanned archives. Combining templates with model-based extraction covers both predictable and free-form content.

Measuring success: throughput, error rates, days payable outstanding (DPO), and audit readiness

Core KPIs to track

-

Throughput — invoices processed per hour or day; monitor trends as models improve.

-

Error rate / first-pass accuracy — percent of documents requiring manual correction.

-

Touchless rate — share of documents fully auto-processed without human intervention.

-

DPO (Days Payable Outstanding) — measure changes in payment timing and capture of early-payment discounts.

Operational and audit metrics

Track SLA compliance for reviews, average exception resolution time, and audit trail completeness (who changed what and when). These metrics validate both performance and control objectives.

How to baseline and iterate

Establish a 30–90 day baseline before major changes. Set realistic targets (increase touchless rate, reduce cycle time, lower error rate) and run A/B tests on rules and model versions. Feed measurement data back into model training and workflow tuning.

Reporting and governance

Expose KPIs in dashboards for finance, procurement, and compliance. Schedule regular reviews to prioritize rules updates, training data collection, and integration fixes so the ai document processing program keeps delivering measurable value.

Summary

Automation turns the invoice headache into a repeatable, auditable process: clean capture and layout‑aware OCR, robust line‑item extraction, validation against master data, rules‑based exception routing with human review, and tight ERP/payroll integrations reduce errors, speed throughput, and make month‑end predictable. For HR and legal teams this means fewer manual entries, faster payroll and benefits reconciliation, clearer contract and compliance trails, and less time spent on audit requests — all while preserving human oversight for edge cases. At its core an AI document approach raises the touchless rate, lowers cost‑per‑invoice, and creates measurable KPIs (throughput, error rate, DPO) that prove value to finance and IT. Ready to pilot a practical workflow and templates? Start exploring at https://formtify.app

FAQs

What is AI document processing?

AI document processing combines OCR, layout analysis, and NLP or model‑based extractors to turn scans and PDFs into structured data that systems can act on. It also layers validation rules, confidence scoring, and human‑in‑the‑loop review so organizations can safely automate high‑volume workflows like AP and payroll.

How does AI summarize documents?

AI summarization uses NLP models to identify and extract key clauses, dates, parties, and financial terms, then generates concise executive summaries or highlights for reviewers. These summaries speed review and routing, but should be paired with human verification for legal or compliance decisions.

Can AI extract data from scanned PDFs?

Yes — modern pipelines use image preprocessing and OCR to convert scanned pages to text, then apply layout‑aware table extraction and entity recognition to pull line items and header fields. Preprocessing and template or model training improve accuracy, and low‑confidence results are typically routed to reviewers.

Is AI document processing secure for sensitive files?

When implemented with encrypted transport and storage, role‑based access controls, retention policies, and secure integrations, AI document processing can meet SOX, GDPR, and other compliance requirements. You should also test in sandbox environments, log all decisions for auditability, and limit access to sensitive fields.

Which tools can create AI documents or process them?

Tooling spans OCR engines, layout‑aware document AI models, table recognition and NLP extractors, and middleware or RPA platforms that integrate with ERPs and payroll systems. Choose vendors that support training with your labeled data, offer secure APIs or connectors, and provide review UIs for human‑in‑the‑loop workflows.