Understanding business structure is essential for anyone embarking on the entrepreneurial journey. The structure you choose for your business can impact everything from taxes to personal liability, and knowing the various options available can be the key to unlocking your venture’s full potential. This comprehensive guide is designed to help you navigate through the myriad of structures and find the one that aligns best with your business goals, personal circumstances, and future ambitions.

Choosing the Right Business Structure: A Comprehensive Guide

Choosing a business structure is not a one-size-fits-all decision. It requires careful consideration of multiple factors, including legal implications, tax benefits, and the level of control you desire over your business.

A well-chosen structure can provide you significant benefits such as limited liability protection, tax advantages, or simplicity in administration. On the other hand, the wrong choice can lead to unnecessary complexities, potential liabilities, and a road filled with obstacles.

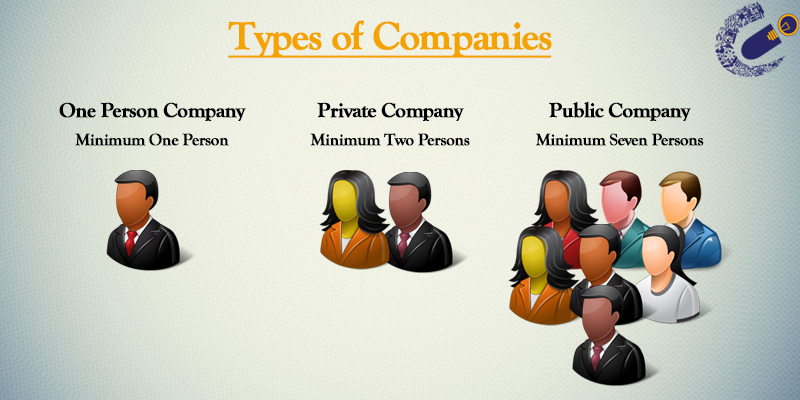

The different types of business structures include Sole Proprietorships, Partnerships, Corporations, Limited Liability Companies (LLCs), and Non-Profits, each with its own set of pros and cons. As you proceed further, you will gain a clearer insight into how your chosen structure can reinforce your entrepreneurial vision.

Understanding Different Business Structures

When considering a business structure, it is crucial to delve into what each one entails. This will impact not only your personal financial future but also how your business operates.

Sole Proprietorship

A Sole Proprietorship is the simplest and most common form of business ownership. As the sole owner, you have complete control over all decisions and receive all profits. However, this comes with the downside of unlimited personal liability for debts incurred by the business.

Since there are fewer formal requirements for establishing a Sole Proprietorship, it is a great option for those just starting out or testing an idea without making significant investments.

Partnership

A Partnership involves two or more people who agree to share the profits and losses of a business. This can lead to a pooling of resources, making it easier to raise capital and manage operational tasks. However, each partner is personally liable for the debts of the business, which means your personal assets can be at risk if the business fails.

Partnerships can take a variety of forms–general partnerships, limited partnerships, and limited liability partnerships (LLPs)–each offering different levels of liability and management responsibilities.

Corporation

A Corporation is a more complex business structure that separates the owners from the business itself, offering limited liability protection to its shareholders. This means that, as a shareholder, your personal assets are generally protected from the corporation’s liabilities.

Corporations also allow businesses to raise capital through the sale of stock and have perpetual existence, which can be vital for long-term planning. However, they come with more regulatory requirements and can be costly to maintain.

LLC and Non-Profit Structures

Limited Liability Companies (LLCs) offer a blend of the features of a corporation and a partnership. Owners enjoy limited liability while also having flexibility in taxation and management structure. This hybrid structure is increasingly popular due to its ease of operation and ability to shield personal assets.

On the other hand, Non-Profits operate for a purpose other than profit. They can also seek tax-exempt status, which can enable them to operate without the burden of state and federal taxes. However, running a Non-Profit requires adhering to specific regulations and can lead to challenges in fundraising and transparency.

Summary: Making an Educated Decision

Every business structure presents unique benefits and drawbacks. As you consider your options, think about factors such as risk tolerance, long-term goals, and intended management structure. As you dive deeper into the implications and decisions behind each structure, you’ll feel more empowered to make the best choice.

Sole Proprietorship vs. Partnership vs. Corporation: Key Differences

Understanding the key differences among Sole Proprietorships, Partnerships, and Corporations is crucial for any business owner. Each structure influences element areas such as management, taxes, liability, and operation dynamics.

Management and Control

In a Sole Proprietorship, the owner makes all decisions single-handedly. This offers complete control but also places all the responsibilities squarely on the owner’s shoulders.

In a Partnership, decision-making becomes more complex as it requires consensus among the partners. This can sometimes lead to conflicts but can also bring diverse perspectives to the table. Clear communication and guidelines are essential to ensure smooth operational flow in partnerships.

Corporations, on the other hand, typically separate ownership and management. Shareholders elect a board of directors to oversee the company’s operations, which can dilute individual control but can also lead to a more democratic process in decision-making.

Tax Implications

Tax treatment differs vastly across these business structures.

A Sole Proprietor reports income on their personal tax return, leading to a straightforward tax process. However, they are liable for self-employment taxes, which can add up quickly.

In a Partnership, profits are passed through to the individual partners, who then report their share on personal tax returns. This can offer flexibility but may complicate matters during tax season.

Corporations may face double taxation, where the company pays taxes on profits, and shareholders also pay taxes on dividends. However, they may qualify for certain tax benefits that can alleviate the burden.

Liability Considerations

Liability is one of the most critical factors when choosing a business structure. In a Sole Proprietorship, the owner faces unlimited liability. This means personal assets can be targeted by creditors or lawsuits.

Partners also carry a similar risk; each partner is generally liable for the entire business’s debts. However, limited partnerships offer some liability protection for certain partners.

Corporations distinctly provide limited liability, meaning that shareholders’ personal assets are generally protected from the corporation’s debts and claims. This can offer peace of mind as you navigate growing business challenges.

Building a Pros and Cons Table

Understanding the pros and cons of each structure at a glance can simplify the decision-making process. Below is a table outlining the distinctions.

| Business Structure | Pros | Cons |

|---|---|---|

| Sole Proprietorship | Easy to set up and complete control | Unlimited personal liability |

| Partnership | Pooling of resources and ideas | Joint liability for debts |

| Corporation | Limited liability protection | Double taxation and more regulatory complexities |

Conclusion: Focus on What Matters

Choosing a business structure is a critical decision that will impact your business significantly. Each structure carries its own set of risks and rewards, making it essential to evaluate your priorities carefully. Whether opting for the simplicity of a Sole Proprietorship or the complex advantages of a Corporation, a clear understanding of these differences will empower you as you embark on your business journey.

Legal and Tax Implications of Different Business Structures

The legal and tax implications of your chosen business structure can often dictate your operational freedom and financial burden. It’s critical to understand these consequences fully, as they will shape how you manage your business.

Legal Requirements and Compliance

Every business structure has its own legal requirements for formation and compliance.

A Sole Proprietorship may require just a business license, but you may need to fulfill local permits depending on your business activities. This minimal regulatory burden is appealing but does leave you vulnerable to personal liability.

In a Partnership, a formal partnership agreement is recommended (though it may not always be required). This document sets expectations and guidelines for the partnership, potentially preventing disputes.

Corporations face a more complex legal landscape. They must register with the state, file articles of incorporation, adhere to regulations, maintain corporate records, hold annual meetings, and report to shareholders. Compliance can be labor-intensive and costly, but it provides a level of credibility that can be beneficial in the market.

Tax Treatment

The tax treatment varies significantly across structures, which can impact profitability.

A Sole Proprietorship is treated as a pass-through entity. All profits are reported on the owner’s individual tax return, simplifying taxation but requiring careful record keeping to manage taxable income.

Partnerships are also pass-through entities, similar to Sole Proprietorships, where partners pay taxes on profits based on their respective shares. This can streamline bookkeeping but make tax time less predictable.

Conversely, Corporations may face double taxation. They pay corporate income tax on profits, and shareholders pay taxes as well when dividends are distributed. However, S Corporations can potentially mitigate this issue by allowing profits and losses to pass through directly to shareholders.

Personal Liability: Who Is at Risk?

When choosing a business structure, understanding personal liability is vital.

In a Sole Proprietorship, all business debts are legally your responsibility, leaving your personal assets exposed. This can create a significant risk, especially if the business struggles.

Partnerships carry similar risks. Generally, each partner’s assets may be at risk due to joint liability. Due diligence and clear communication are necessary to ensure all partners are on the same page regarding risk and responsibilities.

On the other hand, Corporations provide limited liability protection protecting personal assets. This shield allows individuals to invest and operate without excessive concern for personal loss should the business experience difficulties.

Finding the Right Balance

Navigating the legal and tax implications of various business structures can be quite intricate. It is advisable to consult with legal and tax professionals as you assess your options. They can guide you on compliance, tax obligations, and liability management, ensuring that you choose a structure that aligns with your long-term objectives and minimizes legal exposure.

Factors to Consider When Selecting a Business Structure

As an entrepreneur, the path to selecting the right business structure is laden with complex considerations. It’s essential to clearly define your short-term and long-term business goals in order to choose the structure that best facilitates your vision.

Size and Scope of Your Business

Consider the size and scope of your business. If you plan to maintain a small operation as a Sole Proprietorship, the simplicity may suit your needs, but if you envision rapid growth and expansion, it could be prudent to consider a Corporation or LLC for enhanced liability protection and complexity management.

Additionally, if your scope includes hiring employees, local regulations and employee benefits will also impact the structure you choose. This could lead you toward a path that necessitates a Corporation or LLC, which can provide a more formal environment for employees and stakeholders.

Future Growth and Funding

As you evaluate your business structure, think about how you plan to grow your business and raise capital.

A Sole Proprietorship is limited in its fundraising ability; personal funds or loans are typically the only available options.

When considering future expansion or the need for extensive capital, both LLCs and Corporations make it easier to raise funds through attracting investors or issuing shares. This can be a pivotal factor when planning for larger projects or scaling your business.

Personal Risk Tolerance

Your personal risk tolerance plays a considerable role in your choice of business structure.

Understanding your comfort level with financial risks and personal liability is crucial. If you are driving towards higher risk with significant business investments, a Corporation or LLC could be critical in shielding your personal assets.

Alternatively, if you feel confident and secure in your personal financial situation, you might opt for a Sole Proprietorship to enjoy the ease of operations and management while accepting the associated risks that come with it.

Understanding Legal Obligations

Every business structure comes with its own set of legal obligations, varying from compliance to operational management.

A Sole Proprietorship requires minimal legal obligations, whereas a Corporation involves comprehensive record-keeping, filing taxes, and adhering to regulations.

It becomes essential that you assess your willingness to manage these legal aspects and the consequences of non-compliance. Selecting the right structure makes navigating these legal obligations easier and alleviates stress in compliance management.

Business Structure and Liability: Protecting Your Personal Assets

By understanding the interplay between business structure and personal liability, you can create a robust strategy to protect your personal assets. Limiting personal liability is crucial not just to safeguard your finances but to ensure peace of mind as an entrepreneur.

Understanding Personal Liability

Liability pertains to the financial obligations and debts that arise within your business, and how they can affect your personal wealth. In instances of legal disputes or business debts, your personal assets can be at risk unless adequately protected.

For Sole Proprietors and general partners, debts incurred by the business can potentially lead to personal financial ruin, especially during downturns or litigation. If the business fails, creditors may seek to recover owed funds by targeting the owners’ personal assets, which raises the stakes significantly.

Incorporating Liabilities through Business Structure

Incorporation or forming an LLC provides a buffer against threats to personal assets. These structures legally separate personal from business liability, insulating your finances. In such arrangements, only the assets owned by the corporation or LLC are subject to claims from creditors or legal action, effectively guarding personal assets against business-related risks.

It’s essential to ensure proper compliance with operational and regulatory requirements if you’re operating under such a structure. The added layer of legal separation can be compromised if the corporation is not maintained correctly or is proven to be nothing more than a façade.

Importance of Business Insurance

Regardless of your chosen business structure, investing in business insurance is paramount for protecting personal assets. Insurance can serve as an additional safety net to defend against legal claims, property damage, and unforeseen business disruptions.

Consider policies such as general liability insurance, professional liability insurance, and business interruption insurance, as they can collectively bolster your asset protection strategy. Taking proactive steps to secure appropriate insurance coverage reinforces your business structure while enhancing financial security.

An Integrated Risk Management Strategy

Overall, a viable integrated risk management strategy is crucial while determining the appropriate business structure. This includes understanding regulatory compliance, maintaining solid separation between personal and business assets, and incorporating relevant insurance coverage.

As you consider your options, remain flexible and willing to revisit your structure as your business evolves and your personal circumstances change. Continuously monitoring your risk exposure can ensure a well-rounded asset protection strategy that serves you well in both the present and future as your business embarks on new ventures.

Evolving Your Business Structure as Your Company Grows

As your business matures, your initial structure may need reevaluation. It is common for entrepreneurs to face shifts in vision, resources, and market demands that can drive the need for an evolved business structure.

Periodic Reassessment

Once you have established your business, revisit its structure periodically to ensure it aligns with the current needs and goals of your enterprise. These reassessments can provide insights that direct you toward necessary changes before issues arise.

Consider factors such as growth potential, updated funding strategies, evolving market conditions, and emerging legal requirements to help guide these assessments. Ensuring flexibility in your approach allows for better adaptation and preparedness for unforeseen challenges.

Transitioning Between Structures

Transitioning from one structure to another may initially seem daunting, but it can be a necessary step toward aligning your business with its goals.

Moving from a Sole Proprietorship to an LLC, for example, may protect your assets more effectively and allow for more reputable opportunities for growth and investment.

Transitioning may require legal formalities, such as re-registering your business, creating new agreements, or seeking new compliance measures, but the long-term advantages of a more suitable structure can far outweigh the temporary complexities.

Preparing for Future Growth

As your company scales, your structure will also need to accommodate growing demands. Laying the foundation for sustainable growth involves adequately preparing for the next stage by considering how your business can evolve within its chosen structure.

If you foresee new investors wanting to participate or significant growth in employee count, establishing an LLC or Corporation may be appropriate. This enables you to invite partnerships or shareholders, thus harnessing their expertise and resources as you develop.

Evaluating Exit Strategies

In tandem with evolution, it is equally important to consider exit strategies. A well-defined exit strategy can shape how you plan for selling, merging, or closing your business.

For instance, Corporations provide clear pathways for transferring ownership through the sale of shares or merger opportunities, while other structures might complicate this process. Not only does this facilitate future transitions, but it ensures that you have a focused strategy in place to navigate such transformative moments.

Conclusion

Selecting the right business structure is a pivotal decision that can influence the trajectory of your venture. By understanding the key considerations including liability, taxes, and legal requirements, as well as being aware of how your business might evolve, you can make an informed decision that aligns with your entrepreneurial aspirations. With the right approach and proactive management, you can establish a solid foundation for growth and success.