Introduction

Cut the back‑and‑forth. Founders routinely lose weeks to messy paperwork, ad‑hoc contracts and cap table surprises — and investors lose patience. This guide gives HR, compliance and legal owners a concise playbook and a ready‑to‑use bundle so you can close faster: a checklist of investor‑grade docs, editable business templates, SAFEs and cap table models that keep diligence tidy and decisions moving.

We also show how to assemble those files (Word, fillable PDFs, spreadsheets), automate intake‑to‑SAFE workflows and e‑sign flows so agreements update your cap table automatically, and set governance and distribution practices that make every investor handoff audit‑ready. Read on for practical steps, naming conventions, clause libraries and automation wiring to make fundraising repeatable and low‑risk.

Checklist of must-have startup docs (business plan, pitch summary, SAFE, cap table, IP assignment) and why each matters to investors

Quick checklist

- Business plan — the roadmap showing market, revenue model and milestones. Use a clear business plan template so investors can evaluate unit economics and growth assumptions.

- Pitch summary / one‑pager — a concise highlight of opportunity, traction and ask; useful for screening and initial interest.

- SAFE (Simple Agreement for Future Equity) — standardizes early capital terms and protects both parties. Investors want to see consistent, well‑executed SAFEs.

- Cap table — an up‑to‑date capitalization table showing ownership, options and dilution scenarios. This is often a gating item for diligence.

- IP assignment & employment agreements — evidence that the company owns its core IP and that founders/employees have assigned rights; critical for investor legal comfort.

Why each matters to investors

- Clarity: A business plan template and a strong pitch summary reduce back‑and‑forth and speed decisioning.

- Risk mitigation: SAFEs and IP assignments address legal and financial exposure.

- Transparency: An accurate cap table demonstrates governance maturity and shows true dilution.

- Operational readiness: Employment and contractor paperwork indicate the team is executing responsibly.

Practical note: keep standard copies of these documents in editable formats so you can supply tailored versions quickly during diligence — investors appreciate fast, clean responses. If you need starter contracts for equity or option plans, see practical templates like these: SAFE (Post‑money), ESOP toolkit and Stock option agreement.

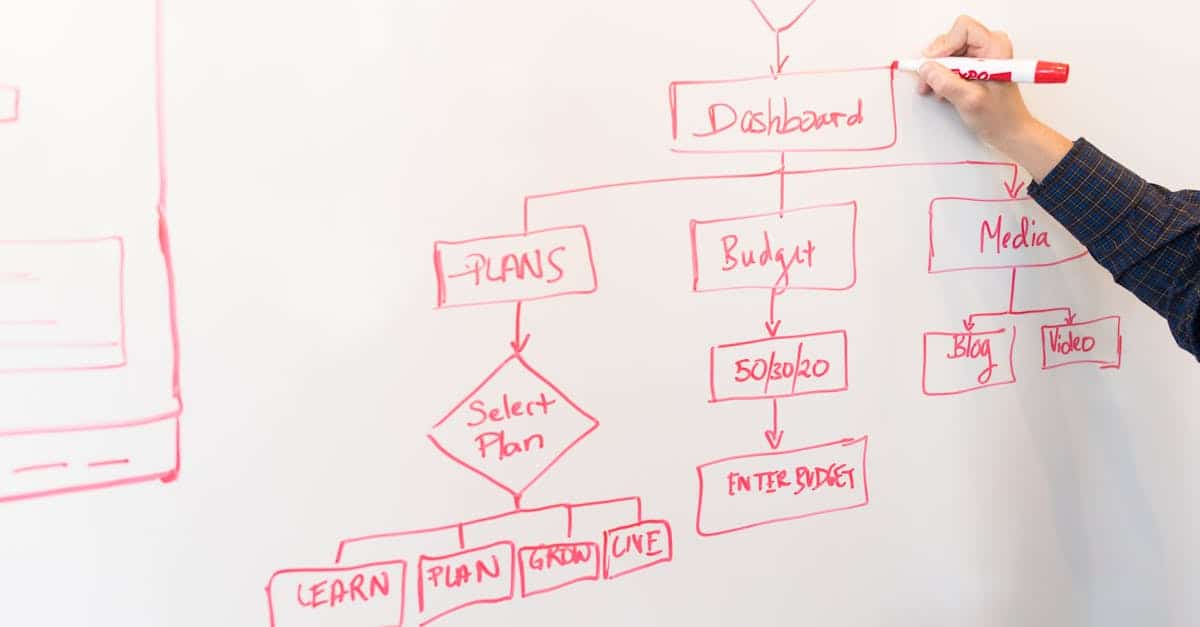

How to assemble an editable template bundle for founders (Word + fillable PDFs + spreadsheets)

Formats to include

- Word / Google Docs: primary editable contract and narrative templates (business plan template, proposal template, pitch deck notes).

- Fillable PDFs: trusted for signatures and distribution when you need a locked format like subscription agreements or investor forms.

- Spreadsheets: cap table models, financial forecasts and an invoice template for billing.

Bundle structure (recommended)

- 01_Docs/Business_Plan_Template.docx — include a business model canvas template appendix.

- 02_Templates/Legal/SAFE_Postmoney.docx and SAFE_Postmoney.pdf

- 03_Finance/Cap_Table.xlsx and Cap_Table_Google_Sheet

- 04_Admin/Invoice_Template.xlsx and Proposal_Template.docx

Practical tips for founders

- Provide both Word and Google Docs versions to support remote collaboration — many teams prefer business templates Google Docs for real‑time editing.

- Create fillable PDFs for client/investor intake and signature to reduce errors.

- Include a prefilled SaaS or service contract for recurring revenue models — see an example SaaS agreement template here.

- Bundle an ESOP and stock option agreement for hiring and retention — include the ESOP set and stock option agreement in the legal folder.

Naming & metadata

Use consistent file names and a version suffix (v1.0, v1.1). Add a small README that lists intended use, editable fields, and who must sign off. This makes your entrepreneurship templates bundle practical for day‑to‑day use.

Automating investor workflows: connect SAFE templates, cap table updates and subscription agreements to intake forms

Why automate

Automation cuts manual handoffs, reduces errors, and gives investors a smoother experience. For example, when a lead signs a SAFE, you want the cap table updated, the subscription agreement generated and the investor record created automatically.

Key components

- Fillable intake form: Collect investor name, amount, accreditation status, and bank details.

- Document generation: Merge form fields into the SAFE template (Word or PDF) to produce a ready‑to‑sign copy.

- E‑sign and storage: Route generated docs to e‑sign providers and store signed versions in a governed folder.

- Cap table sync: Push the investment to your cap table spreadsheet or equity management tool to reflect new shares/SAFE conversion terms.

How to wire it

- Use form tools that output structured data (CSV/JSON) and webhooks to trigger document generation.

- Connect document templates like this SAFE: SAFE (Post‑money) to your automation platform.

- Integrate with spreadsheets (Google Sheets or Excel online) so cap table rows update automatically, and send notifications to founders and legal.

Tools & integrations

Common stacks: form + document merge + e‑sign + spreadsheet/CRM. Platforms like Zapier, Make, or native integrations in your form or e‑sign provider will handle these flows. The result: faster closings, fewer manual updates, and a reproducible investor onboarding path that scales as you take more capital.

Template governance: legal review checkpoints, clause libraries and version control for investor-facing docs

Governance principles

Treat investor‑facing templates as controlled assets. That means defined approval steps, a clause library for standard language, and strict version control so everyone uses the right document.

Legal review checkpoints

- Draft approval: Legal reviews new or modified templates before they enter circulation.

- Pre‑use signoff: Require a quick legal check for any deviation from the standard (pricing, special exclusives, material legal changes).

- Periodic audit: Quarterly review of templates to ensure compliance with new laws or investment norms.

Clause library & modular templates

Create a searchable clause library for recurring provisions (confidentiality, IP assignment language, warranties, indemnities). Build templates that assemble from approved clause blocks so lawyers only need to approve clauses once.

Version control & access

- Use a single source repository (cloud folder or document management system) with enforced naming and changelogs.

- Restrict edit permissions to legal or designated owners; provide read‑only copies for founders and sales.

- Tag each template with metadata: version, approver, effective date, and change summary.

These practices create a corporate templates library that reduces legal risk and speeds investor interactions. Keeping an audit trail also makes diligence easier for potential investors and auditors.

Distribution & investor handoff: packaging templates, e‑sign workflows and storing audit-ready records

Packaging templates for handoff

Bundle the exact set an investor needs: pitch summary, business plan template, SAFE or subscription agreement, latest cap table, and IP confirmations. Provide both editable and signed‑ready formats (Docs/Word + PDF).

E-sign workflows

- Prepare: Generate the document from template with merged fields from your intake form.

- Send: Route to the investor via an e‑sign provider with a clear signing order and reminders.

- Confirm: Once signed, push the signed PDF back into your records and trigger the cap table update.

Storing audit‑ready records

- Save signed docs in an immutable or versioned storage location with timestamped metadata.

- Keep a transaction folder per investor that includes the intake form, signed agreements, payment receipts, and cap table snapshot.

- Export an audit pack for each round that contains all executed agreements, board approvals, and the cap table history.

Small operational details matter: include a clear filename convention, a checklist for closing (who approves funds release, who updates the cap table), and a note field with any negotiated deviations. When these processes are set, investor handoffs become predictable and audit‑ready — and you reduce the back and forth that slows closings. For recurring contract needs in services or SaaS deals, keep an up‑to‑date template like this SaaS agreement in your distribution set: SaaS template. Also make sure invoices and administrative templates (invoice template, proposal template) are included so post‑close operations are smooth.

Summary

This guide lays out a compact playbook for founders and their HR, compliance, or legal partners: keep a tight checklist of investor‑grade documents, assemble them in editable formats (Docs, fillable PDFs, spreadsheets), wire automation from intake to SAFE generation and cap table updates, and enforce template governance so every investor handoff is audit‑ready. Document automation not only removes repetitive work but also reduces errors, speeds closings, and keeps HR and legal teams focused on review and exceptions instead of manual updates. Treat your document library—your business templates—as a controlled asset, and you’ll get cleaner diligence, faster investor decisions, and fewer surprises at close. Ready to put these practices into action? Browse starter kits and automation-ready templates at https://formtify.app.

FAQs

What are business templates?

Business templates are pre‑formatted documents and spreadsheets—like business plans, SAFEs, cap tables, and invoices—designed to standardize common workflows. They help teams move faster by providing consistent structure and required fields, reducing back‑and‑forth during diligence and operations.

Where can I find free business templates?

You can find free templates from reputable sources like government small‑business sites, industry associations, and template marketplaces. For startup‑focused, automation‑ready sets that include SAFE and cap table models, repositories such as Formtify offer curated starter kits you can download and adapt.

How do I customize a business template?

Start by identifying the fields and clauses that must change for your use case, then adapt the language while keeping a record of edits and version numbers. Always run material changes past legal for a quick signoff and keep editable and locked copies (Docs for editing, PDFs for signing) to support both collaboration and compliance.

Are business templates legal to use?

Yes—templates are legal tools, but they are not one‑size‑fits‑all legal advice. Use them as a starting point and have a lawyer review any material modifications, jurisdictional clauses, or investor terms to ensure compliance with local law and investor expectations.

How do I choose the right business template?

Pick templates that match your specific workflow (fundraising vs. hiring vs. sales), are available in editable and signable formats, and support automation where possible. Prefer templates from trusted sources, check for governance metadata (version, approver), and confirm they can integrate with your e‑sign and cap table tools.