Introduction

Why this matters

Cross‑border and multi‑state sales have turned simple invoicing into a compliance minefield: missing VAT or state IDs, incorrect tax rates, overlooked reverse‑charge rules, and fragmented reporting all lead to audits, penalties and wasted time. As jurisdictions multiply and thresholds shift, finance and legal teams end up patching invoices and chasing documentation instead of focusing on growth.

Use document automation to make invoices tax‑ready: design business templates that capture seller and buyer tax IDs, provide line‑item tax breakdowns and explicit reverse charge fields, show conditional fields for regional rules, integrate with tax engines to automate calculations and filings, and build robust audit trails and retention. The sections below walk through practical template elements, localization and automation patterns, exemption and threshold logic, and QA/retention practices so your invoices are accurate, auditable and ready for reporting.

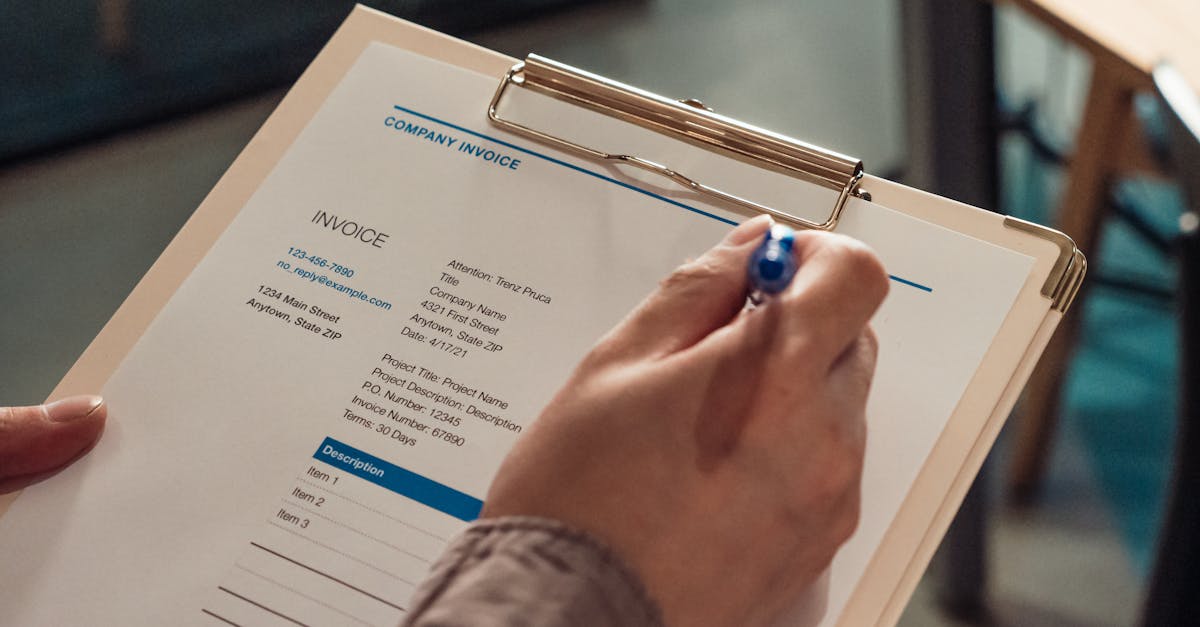

Key invoice components for tax compliance: tax IDs, line‑item tax breakdowns, and reverse charge fields

Seller and buyer tax IDs

Always include clear tax identifiers for both parties: VAT/GST numbers, EINs or other local tax IDs. These are essential for cross‑border compliance and audits. Capture alternative identifiers when customers supply them (e.g., EU VAT ID vs a US EIN).

Line‑item tax breakdowns

Break taxes out per line item rather than showing a single aggregate tax. Include these fields:

- Description — what the item or service is.

- Taxable base — net amount subject to tax.

- Tax rate and code — percent and jurisdiction code.

- Tax amount — calculated value per line.

Line‑level detail makes it easier to reconcile with tax returns and supports partial exemptions or mixed tax treatments.

Reverse charge and cross‑border fields

For B2B cross‑border sales, include explicit reverse charge indicators, the legal basis (e.g., ‘reverse charge — Article 196’), and a place to record the buyer’s VAT ID. Without explicit fields, accounting teams may miss reverse charge treatments.

If you use ready-made business templates such as invoice templates, check they include these tax fields. For a practical starting template, see this invoice template you can adapt: https://formtify.app/set/invoice-e50p8.

Building region-aware invoice templates: conditional fields for state sales tax vs VAT and localization tips

Conditional fields and logic

Design templates with conditional logic so fields appear only where relevant. Examples:

- Show state sales tax fields only when the seller or buyer is in the same US state.

- Show VAT registration and reverse charge fields for EU B2B transactions.

- Toggle tax‑inclusive vs tax‑exclusive pricing by country.

Localization tips

Localize number formats, currency symbols, date formats, language, and rounding rules. Small differences — like how VAT is displayed in invoices — can cause downstream errors in filing.

Consider multiple export formats (PDF, XML, JSON) to meet different filing or ERP ingestion needs. If your team uses business templates in Word or Google Docs, ensure your shared versions handle localization: business templates word and business templates google docs should have localized examples and conditional placeholders.

Cross‑template consistency

Link invoices to related documents like sales and purchase agreements so tax terms are aligned. Example templates to reference when building contract‑aware invoices:

- Sales agreements: https://formtify.app/set/sales-agreement-58191

- Purchase agreements: https://formtify.app/set/purchase-agreement-5ongq

Automating tax calculation and filing: connect templates to tax engines, trigger reports and maintain audit trails

Connect templates to tax engines

Integrate invoice templates with tax calculation services (e.g., Avalara, TaxJar, or your ERP tax module). This avoids manual rate lookups and ensures jurisdictional accuracy. Map template fields (line amounts, tax codes, addresses) to the tax engine inputs.

Triggering reports and filings

Use template events to automate downstream tasks:

- On invoice finalization → update sales journal and populate tax report drafts.

- On month‑end → trigger consolidated tax filing exports (XML or CSV) based on template data.

- On threshold events → notify finance for registration and filing tasks.

Audit trails and evidence capture

Record every template rendering, who approved it, and the version used. Keep signed PDFs and the underlying data payload so you can reconstruct filings during audits. This practice scales from simple invoice templates to more complex project management templates or business proposal templates where financial terms affect tax.

Think about the tools your team uses — how to create business templates and the best tools for business templates — and ensure integrations are supported.

Handling exemptions and thresholds: template logic for tax-exempt customers, resale certificates and threshold-based registration

Capture exemption details at the point of invoicing

Add fields for exemption type (non‑profit, diplomatic, small business), a legal reason, certificate ID, and an upload link for the supporting document. Make the exemption field conditional and validate the certificate dates and jurisdiction.

Resale certificates and verification

For resellers, include structured fields for the resale certificate number, issuing jurisdiction, and an expiry date. If possible, automate a verification step (API or manual review) before applying tax exemption.

Threshold‑based registration logic

Implement rules that track cumulative sales by jurisdiction and trigger registration workflows when thresholds are met. Templates should:

- Tag transactions by jurisdiction.

- Aggregate sales on configurable rolling periods.

- Alert finance when approaching or exceeding thresholds.

These patterns are especially important for small sellers using business templates for small business operations — they help avoid surprises and late registrations.

Template QA and retention: versioning, evidence capture for filings and DSAR readiness

Version control and approvals

Keep a strict versioning policy for all business templates. Record who made changes, why, and the effective date. Gate major updates behind an approval workflow so tax and legal teams sign off before use in production.

Evidence capture for audits and filings

Store the rendered invoice (PDF), the raw data payload (JSON/XML), calculation logs, and any external tax engine responses. Retain metadata: template version, approver, timestamp, and IP/user details. This is the core of a reliable audit trail.

DSAR readiness and data retention

Design retention schedules aligned to local laws and your privacy obligations. For Data Subject Access Requests (DSARs), ensure you can locate and export an individual’s invoices and linked documents quickly. Implement redaction workflows for sensitive fields when producing documents.

Practical tips

- Automate backups and immutable storage for long‑term retention.

- Include a retention field in templates so the document itself carries metadata about how long it must be kept.

- Run periodic QA checks against a sample of templates and rendered outputs to catch regressions in tax logic.

Following these practices will make your business templates—whether business plan templates, marketing plan templates, or invoice templates—safer, auditable, and easier to maintain.

Summary

Cross‑border and multi‑state sales require invoices that are precise, auditable and regionally aware: capture seller and buyer tax IDs, show line‑item tax breakdowns, include explicit reverse‑charge fields, and surface conditional fields for state‑ or country‑specific rules. Connect templates to tax engines to automate rate lookups, filings and threshold alerts, and keep strict versioning, evidence capture and retention so audits and DSARs are straightforward. For HR and legal teams this means fewer manual checks, clearer evidence for compliance reviews, and faster onboarding of finance processes — all of which reduce risk and free your teams to focus on strategic work. Start adapting your business templates for tax readiness and automation today: https://formtify.app

FAQs

What is a business template?

A business template is a pre‑structured document you can reuse to standardize routine work like invoices, contracts, or proposals. It captures the fields and logic your team needs so outputs are consistent, auditable and faster to produce.

How do I create a business template in Word?

Start with a clean layout and add clearly named placeholders for key fields (dates, amounts, tax IDs). Use Word features like content controls or mail‑merge fields, save as a .dotx template, and maintain versioning and approval notes so changes are tracked.

Are business templates free to use?

There are many free templates available that suit basic needs, but check licensing and whether they meet your compliance requirements. For automation, integrations and legal review you may need paid tools or custom templates built to your processes.

Where can I download business templates?

You can find templates from vendor sites, template marketplaces, and platform libraries that specialize in legal and finance documents. For tax‑ready invoice and contract templates you can also explore curated sets and automation tools such as https://formtify.app.

Can I customize business templates for my brand?

Yes — templates should be customized with your logo, colors, and preferred wording, and extended with conditional fields or localized formats where needed. Keep styling separate from tax and compliance logic so you can update branding without risking the underlying legal or tax data.